As you may know by now, your bad credit report will not disappear as some may wish. Bad credit will linger around until you do something about it. To be quite frank, it will be like a “dark cloud” over your head until you fix it. In this article I wanted to discuss the FACTS about repairing your own credit for FREE. I have lots of experience since I have been in lending for years. I know all the tips and tricks. There are lots of credit repair companies that advertise they can remove collections, bankruptcies, foreclosures, and the list goes on…….. I will be the first to tell you and so will the FTC, “You cannot REMOVE obligations from your credit report that you owe.” Here are the steps to fix your credit report.

As you may know by now, your bad credit report will not disappear as some may wish. Bad credit will linger around until you do something about it. To be quite frank, it will be like a “dark cloud” over your head until you fix it. In this article I wanted to discuss the FACTS about repairing your own credit for FREE. I have lots of experience since I have been in lending for years. I know all the tips and tricks. There are lots of credit repair companies that advertise they can remove collections, bankruptcies, foreclosures, and the list goes on…….. I will be the first to tell you and so will the FTC, “You cannot REMOVE obligations from your credit report that you owe.” Here are the steps to fix your credit report.

1. Pull your credit report

It is extremely hard to fix what you cannot see. So the first step is to pull your free credit report and review that credit report. There are lots of places on the web to pull your credit report, and all of them offer different services. You can go to www.annualcreditreport.com which is the only place on the web that you can get your credit report for FREE, once a year. This website does not provide you with your credit scores. I recommend getting your credit report with credit scores. You can go here and get your free credit report with credit scores on a trial basis. Make sure you cancel the service they sign you up for within the trial period. Once you have printed out your credit report review it for inaccuracies and collections.

2. Determine your budget to settle on collections

Yes, you heard me right; you need to determine what you can afford to start settling on the collections you have acquired. After you have reviewed your credit report, I always recommend that you make note of all collections starting with the most recent. Determine what the total cost is to pay off these creditors. Typically these collection companies will take pennies on the dollar. The number for the collection companies reporting these collections are on the credit report, normally towards the back.

Collections cost: $700.00

Offer them: $275.00

3. Remove inaccurate information from your report.

It is very common to have information on your credit report that is not correct. So comb your personal credit report for information that might need to be disputed. Remember, it does not good to dispute information on your report that you know you owe, unless the collection has been on your credit report for over 7 years. Go here to dispute with each credit bureau.

4. Credit Education

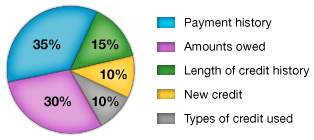

Once you have paid off your collections, it is important to know what not to do so you don’t have the same problem again. Credit education is crucial so there is no more future problems. The number one problem I see is late payments. If you are in the process of working on fixing your credit, but decide to be late on payments; don’t bother fixing your credit. Late payments will defeat the whole purpose. Your payment history makes up 35% of your overall FICO credit score. So, don’t be late on anything ever again.

Don’t charge up your credit cards. A credit card is for small ticket items or emergencies only. Don’t charge more on a credit card than you can pay off the following month. Your credit balances accounts for 30% of your overall credit score. You should not have more than 20% of your credit limit charged up on a credit card.

6. Re-Pull your credit report Remember working on your credit is not a quick fix process. This process could take up to a year. Be patient and if you follow exactly what I recommended your credit worthiness will increase. If you have any questions, feel free to e-mail me. mike@mikeclover.com

Your credit scores are determined by your payment history to creditors. You must have at least 2 lines of credit reporting on your credit report. If all your good credit went to collection, you will need to re-establish good credit. Since your credit scores maybe too low to get un-secured credit cards, you will need to get a couple of secured credit cards. Go here to get a couple of secured credit cards. Secured credit cards are typically the only way to re-establish good credit. Ideally you need 3 lines of credit reporting on your credit report, usually a mix of credit, such as, credit cards, car loans, installment loans, etc….. A mix of credit is 10% of your over all credit score.

Once you have paid off all your collections and disputed inaccurate information, you will need to pull a copy of your credit report to make sure everything has been updated with the credit bureaus properly. I recommend waiting at least 90 days after the last paid collection took place.